3. Binomial Model

The binomial regression model is used when the response variable is variable with two possible outcomes.

Example 1:

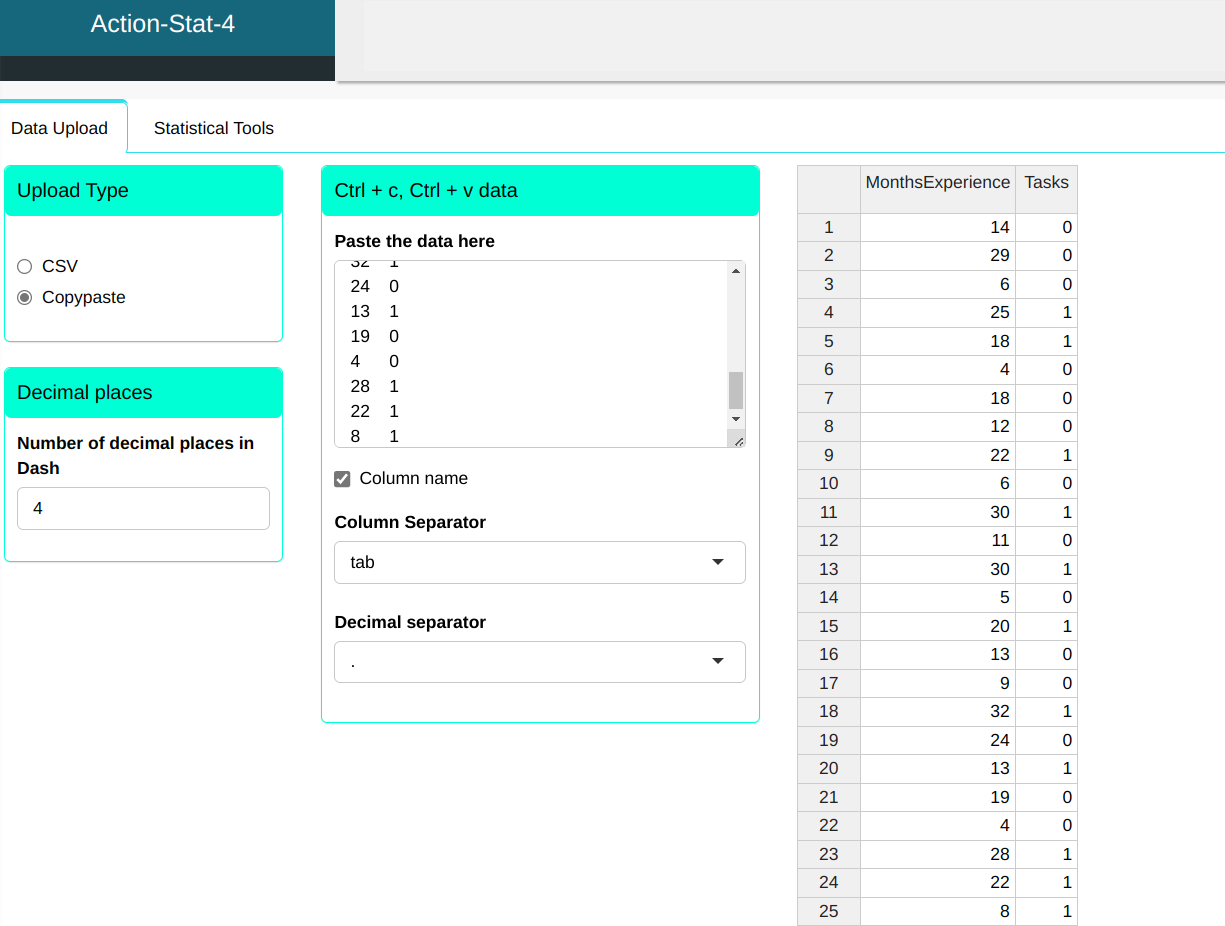

An analyst is studying the effect of length of experience in computer programming on the ability to complete a difficult task within a given time. Twenty-five programmers were selected for the study. The predictor variable, X, corresponds to months of experience.

Observation:

Tasks (Y)=1, whether the task was successfully completed in the time allowed, and

Tasks (Y)=0, if the task was not completed successfully.

| MonthsExperience | Tasks |

|---|---|

| 14 | 0 |

| 29 | 0 |

| 6 | 0 |

| 25 | 1 |

| 18 | 1 |

| 4 | 0 |

| 18 | 0 |

| 12 | 0 |

| 22 | 1 |

| 6 | 0 |

| 30 | 1 |

| 11 | 0 |

| 30 | 1 |

| 5 | 0 |

| 20 | 1 |

| 13 | 0 |

| 9 | 0 |

| 32 | 1 |

| 24 | 0 |

| 13 | 1 |

| 19 | 0 |

| 4 | 0 |

| 28 | 1 |

| 22 | 1 |

| 8 | 1 |

We will upload the data to the system.

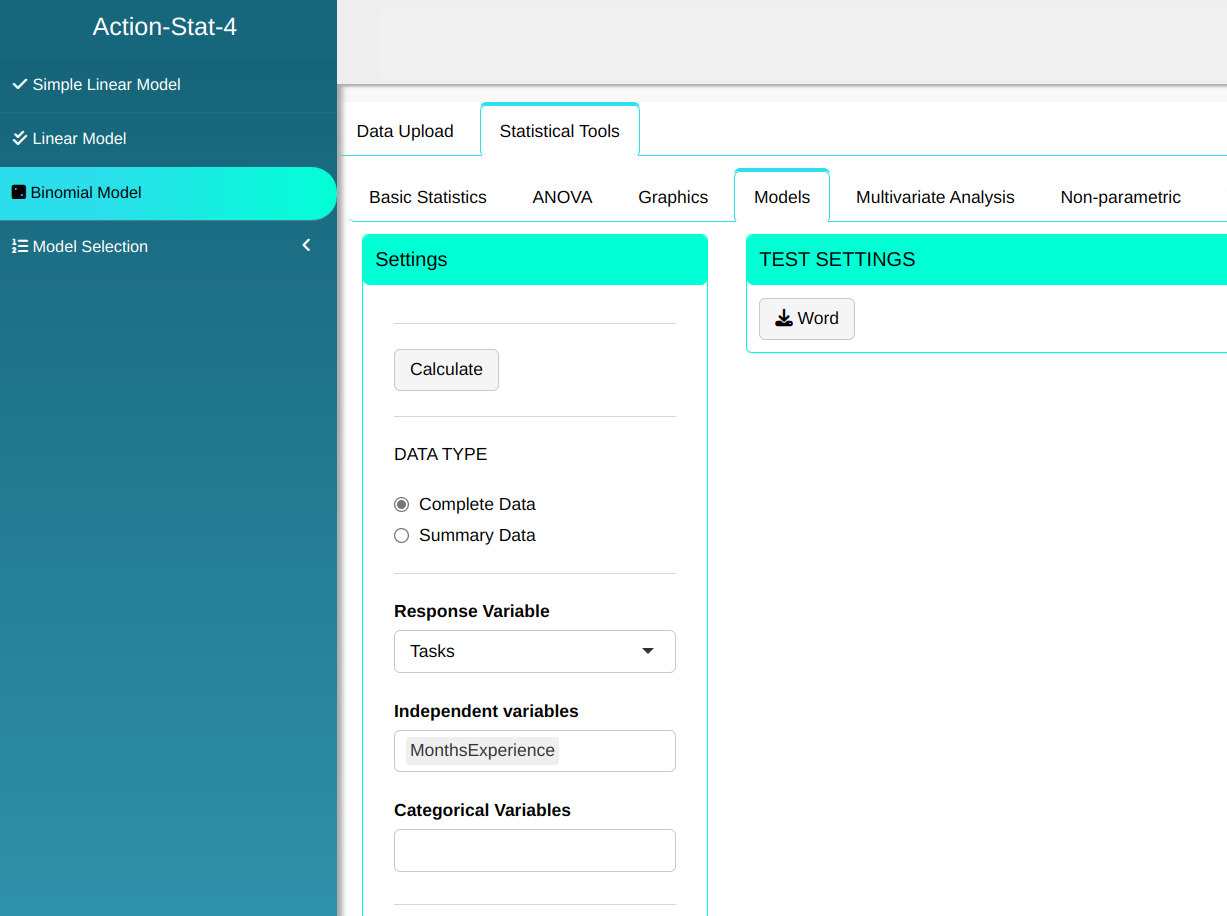

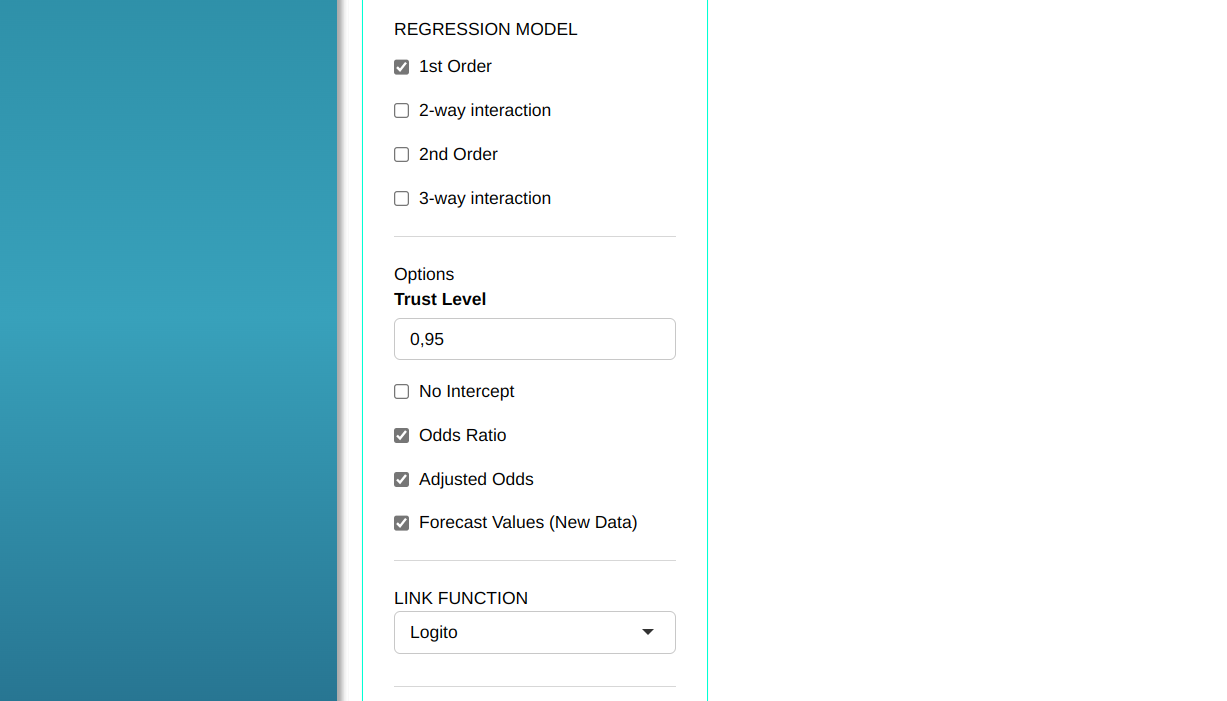

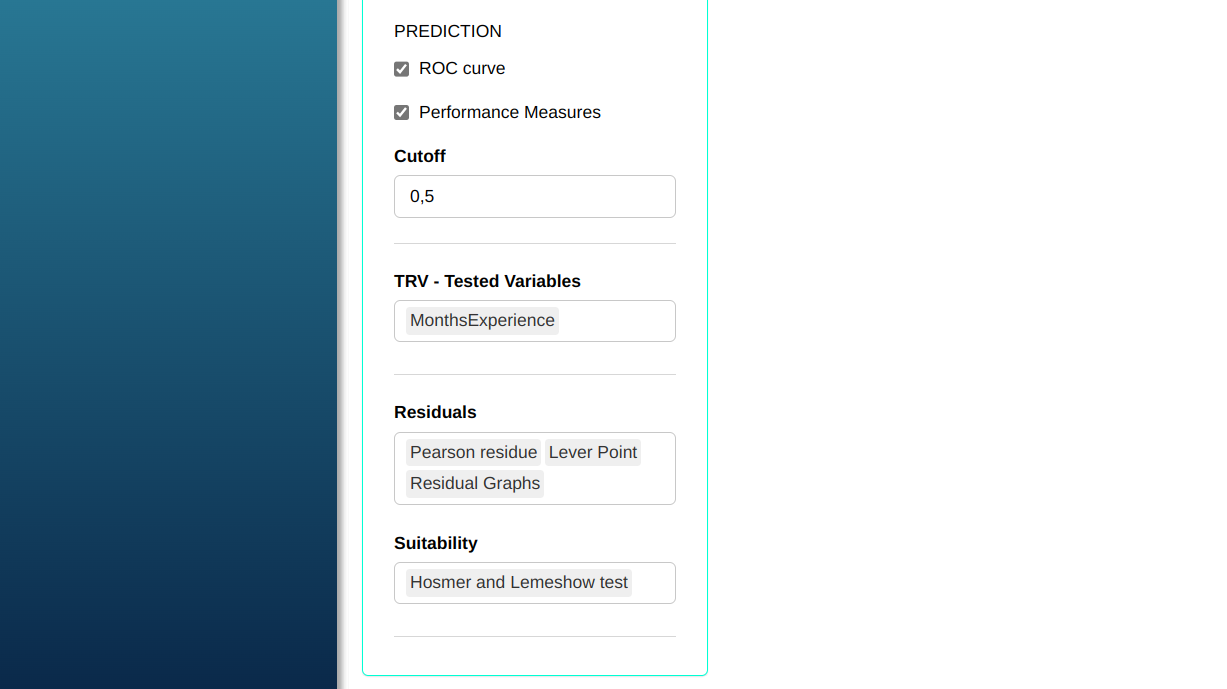

Configuring as shown in the figure below to perform the analysis.

Then click Calculate to get the results. You can also generate the analyses and download them in Word format.

The results are:

Estimated Coefficients Table

| Estimate | Standard Deviation | Wald Test | P-Value | Lower Limit | Upper Limit | |

|---|---|---|---|---|---|---|

| Intercept | -3.0596959 | 1.25934986 | -2.429584 | 0.0151 | -5.52797622 | -0.5914155 |

| MonthsExperirnce | 0.1614859 | 0.06498001 | 2.485163 | 0.0129 | 0.03412744 | 0.2888444 |

Covariance Matrix

| (Intercept) | MonthsExperience | |

|---|---|---|

| (Intercept) | 1.5859621 | -0.075402604 |

| MonthsExperience | -0.0754026 | 0.004222402 |

General Information

| Information | Value |

|---|---|

| Fisher Scoring Interation | 4 |

| Null Deviance | 34.296 with 24 Degrees the Freedom |

| Residual Deviance | 25.425 with 23 Degrees the Freedom |

| AIC | 29.4245740804509 |

| Dispersion Parameter | 1 |

Resultado da análise

| Real | V2 | |

|---|---|---|

| Predito | Tasks=0 | Tasks=1 |

| Tasks=0 | 13 | 6 |

| Tasks=1 | 1 | 5 |

Summary (Performance)

| Percentage (%) | |

|---|---|

| Sensitivity | 45.45455 |

| Specificity | 92.85714 |

| PPV | 83.33333 |

| NPV | 68.42105 |

| Accuracy | 72.00000 |

Odds-Ratio Table

| Variable | Category | Odds Ratio | Lower Limit | Upper Limit |

|---|---|---|---|---|

| MonthsExperience | 1.1752559100685 | 1.03471646443219 | 1.3348840012021 |

Intervalo de Previsão

| MonthsExperience | Adjusted Probability | LL | UL | Standard Deviation | |

|---|---|---|---|---|---|

| 1 | 14 | 0.31026237 | 0.079658965 | 0.5408658 | 0.11765696 |

| 2 | 29 | 0.83526292 | 0.599589805 | 1.0709360 | 0.12024360 |

| 3 | 6 | 0.10999616 | -0.065139980 | 0.2851323 | 0.08935681 |

| 4 | 25 | 0.72660237 | 0.464020009 | 0.9891847 | 0.13397306 |

| 5 | 18 | 0.46183704 | 0.223425450 | 0.7002486 | 0.12164080 |

| 6 | 4 | 0.08213002 | -0.069291566 | 0.2335516 | 0.07725733 |

| 7 | 12 | 0.24566554 | 0.020497984 | 0.4708331 | 0.11488352 |

| 8 | 22 | 0.62081158 | 0.363141740 | 0.8784814 | 0.13146662 |

| 9 | 30 | 0.85629862 | 0.632385431 | 1.0802118 | 0.11424352 |

| 10 | 11 | 0.21698039 | -0.003406564 | 0.4373674 | 0.11244439 |

| 11 | 5 | 0.09515416 | -0.068239496 | 0.2585478 | 0.08336564 |

| 12 | 20 | 0.54240353 | 0.294917361 | 0.7898897 | 0.12627078 |

| 13 | 13 | 0.27680234 | 0.048333968 | 0.5052707 | 0.11656764 |

| 14 | 9 | 0.16709980 | -0.038978483 | 0.3731781 | 0.10514391 |

| 15 | 32 | 0.89166416 | 0.694547616 | 1.0887807 | 0.10057152 |

| 16 | 24 | 0.69337941 | 0.430252386 | 0.9565064 | 0.13425095 |

| 17 | 19 | 0.50213414 | 0.259630105 | 0.7446382 | 0.12372882 |

| 18 | 28 | 0.81182461 | 0.566052911 | 1.0575963 | 0.12539603 |

| 19 | 8 | 0.14581508 | -0.050963101 | 0.3425933 | 0.10039887 |

Prediction Interval

| MonthsExperieence | Adjusted Probability | LL | UL | Stadard Deviation | |

|---|---|---|---|---|---|

| 1 | 14 | 0.31026237 | 0.079658965 | 0.5408658 | 0.11765696 |

| 2 | 29 | 0.83526292 | 0.599589805 | 1.0709360 | 0.12024360 |

| 3 | 6 | 0.10999616 | -0.065139980 | 0.2851323 | 0.08935681 |

| 4 | 25 | 0.72660237 | 0.464020009 | 0.9891847 | 0.13397306 |

| 5 | 18 | 0.46183704 | 0.223425450 | 0.7002486 | 0.12164080 |

| 6 | 4 | 0.08213002 | -0.069291566 | 0.2335516 | 0.07725733 |

| 7 | 18 | 0.46183704 | 0.223425450 | 0.7002486 | 0.12164080 |

| 8 | 12 | 0.24566554 | 0.020497984 | 0.4708331 | 0.11488352 |

| 9 | 22 | 0.62081158 | 0.363141740 | 0.8784814 | 0.13146662 |

| 10 | 6 | 0.10999616 | -0.065139980 | 0.2851323 | 0.08935681 |

| 11 | 30 | 0.85629862 | 0.632385431 | 1.0802118 | 0.11424352 |

| 12 | 11 | 0.21698039 | -0.003406564 | 0.4373674 | 0.11244439 |

| 13 | 30 | 0.85629862 | 0.632385431 | 1.0802118 | 0.11424352 |

| 14 | 5 | 0.09515416 | -0.068239496 | 0.2585478 | 0.08336564 |

| 15 | 20 | 0.54240353 | 0.294917361 | 0.7898897 | 0.12627078 |

| 16 | 13 | 0.27680234 | 0.048333968 | 0.5052707 | 0.11656764 |

| 17 | 9 | 0.16709980 | -0.038978483 | 0.3731781 | 0.10514391 |

| 18 | 32 | 0.89166416 | 0.694547616 | 1.0887807 | 0.10057152 |

| 19 | 24 | 0.69337941 | 0.430252386 | 0.9565064 | 0.13425095 |

| 20 | 13 | 0.27680234 | 0.048333968 | 0.5052707 | 0.11656764 |

| 21 | 19 | 0.50213414 | 0.259630105 | 0.7446382 | 0.12372882 |

| 22 | 4 | 0.08213002 | -0.069291566 | 0.2335516 | 0.07725733 |

| 23 | 28 | 0.81182461 | 0.566052911 | 1.0575963 | 0.12539603 |

| 24 | 22 | 0.62081158 | 0.363141740 | 0.8784814 | 0.13146662 |

| 25 | 8 | 0.14581508 | -0.050963101 | 0.3425933 | 0.10039887 |

Likelihood-Ratio Test (LRT)

| Tested Variables | Test Statisti | Degrees of Freedom | P-Value |

|---|---|---|---|

| MonthsExperience | 8.871916 | 1 | 0.002895911 |

Hormer and Lemeshow Test

| Test Statistic | Degrees of Freedom | P-Value | Number of groups | |

|---|---|---|---|---|

| tabHosmer | 0.8636609 | 1 | 0.3527162 | 3 |

| X | 0.1032996 | 2 | 0.9496614 | 4 |

| X.1 | 2.1663561 | 3 | 0.5386055 | 5 |

| X.2 | 1.6652041 | 4 | 0.7970282 | 6 |

| X.3 | 3.4095112 | 5 | 0.6371218 | 7 |

| X.4 | 3.1422227 | 6 | 0.7907964 | 8 |

| X.5 | 6.4255004 | 7 | 0.4910340 | 9 |

| X.6 | 6.5599688 | 8 | 0.5847638 | 10 |

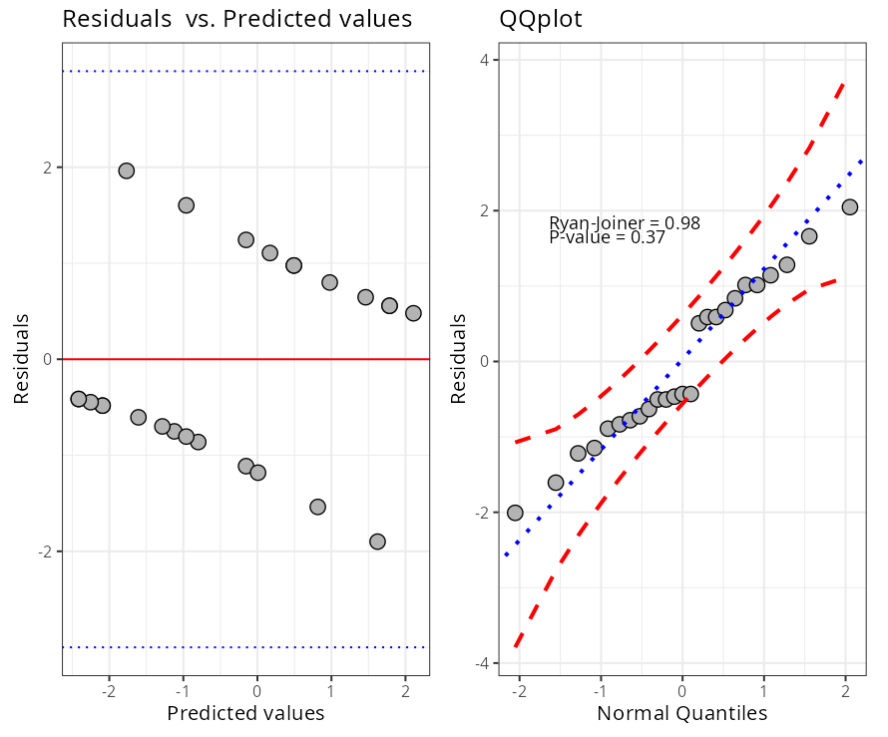

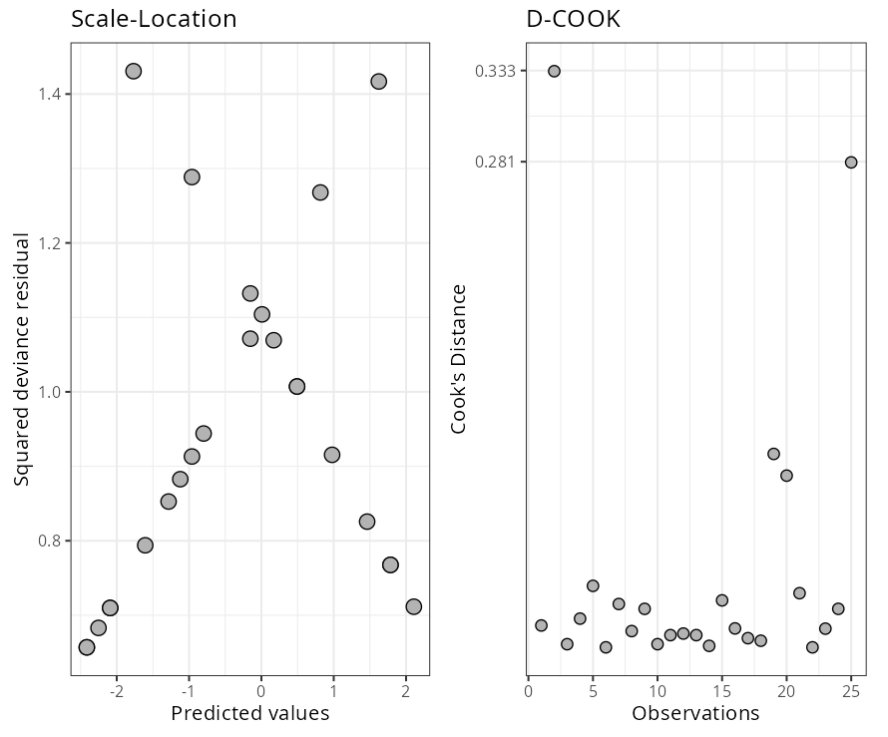

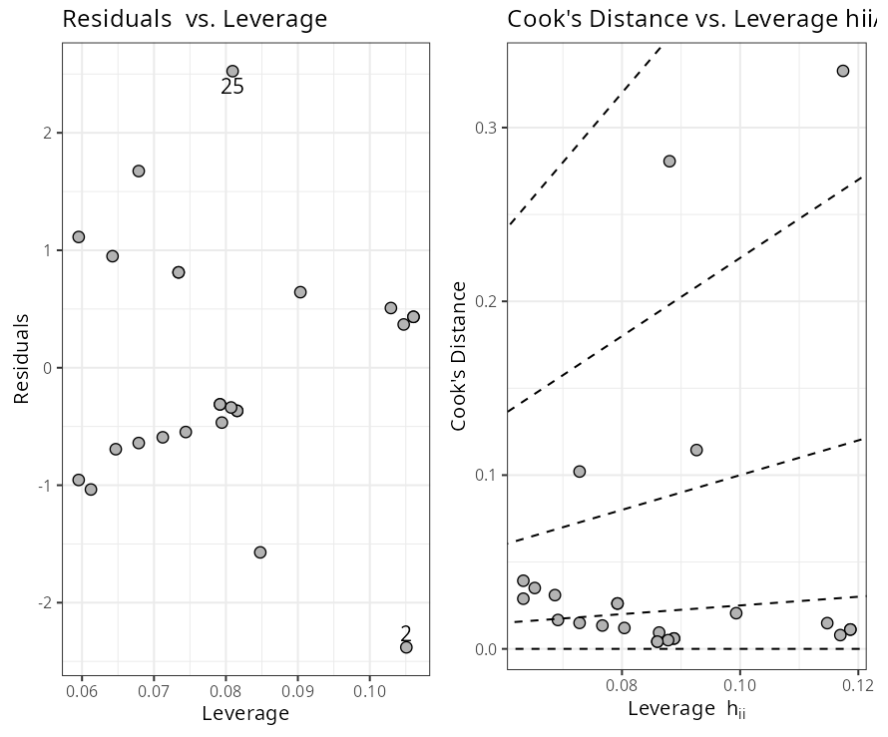

Residual Table

| Deviance Residual | Pearson Residual | Leverage | Cook’s Distance | |

|---|---|---|---|---|

| 1 | -0.8912168 | -0.6934965 | 0.06468785 | 0.016631244 |

| 2 | -2.0075616 | -2.3802536 | 0.10507761 | 0.332614571 |

| 3 | -0.5037418 | -0.3668326 | 0.08156202 | 0.005975083 |

| 4 | 0.8379723 | 0.6431504 | 0.09035322 | 0.020543100 |

| 5 | 1.2817536 | 1.1131167 | 0.05953276 | 0.039216040 |

| 6 | -0.4314357 | -0.3117255 | 0.07917694 | 0.004177699 |

| 7 | -1.1478806 | -0.9552469 | 0.05953276 | 0.028881095 |

| 8 | -0.7791504 | -0.5921530 | 0.07122100 | 0.013444157 |

| 9 | 1.0143989 | 0.8119069 | 0.07342029 | 0.026116551 |

| 10 | -0.5037418 | -0.3668326 | 0.08156202 | 0.005975083 |

| 11 | 0.5891404 | 0.4332766 | 0.10606643 | 0.011137127 |

| 12 | -0.7269990 | -0.5471630 | 0.07441893 | 0.012035729 |

| 13 | 0.5891404 | 0.4332766 | 0.10606643 | 0.011137127 |

| 14 | -0.4664129 | -0.3382224 | 0.08071868 | 0.005022274 |

| 15 | 1.1434517 | 0.9495059 | 0.06423926 | 0.030945750 |

| 16 | -0.8338729 | -0.6407963 | 0.06787813 | 0.014950895 |

| 17 | -0.6302671 | -0.4668354 | 0.07943296 | 0.009402490 |

| 18 | 0.5061151 | 0.3683859 | 0.10470752 | 0.007935766 |

| 19 | -1.6072596 | -1.5718845 | 0.08477399 | 0.114431488 |

| 20 | 1.6601125 | 1.6741998 | 0.06787813 | 0.102056745 |

| 21 | -1.2189489 | -1.0365150 | 0.06123640 | 0.035040847 |

| 22 | -0.4314357 | -0.3117255 | 0.07917694 | 0.004177699 |

| 23 | 0.6817493 | 0.5083200 | 0.10293029 | 0.014823864 |

| 24 | 1.0143989 | 0.8119069 | 0.07342029 | 0.026116551 |

| 25 | 2.0469291 | 2.5246445 | 0.08092914 | 0.280625042 |

Last modified 19.11.2025: Atualizar Manual (288ad71)